Being self-employed has its advantages. For one thing, you’ll have the freedom of being your own boss. In other words, you get to decide your own work schedule!

That’s not to say that there aren’t any cons, though. For starters, you’ll have to figure out your own taxes. Not only that, but you might have to create your own pay stubs.

What is a pay stub? What is it for? Want to know? If so, you’re on the right page. We’ll be going over all the things that you’ll need to know about it below. So be sure to read the rest of the page!

What Is a Pay Stub?

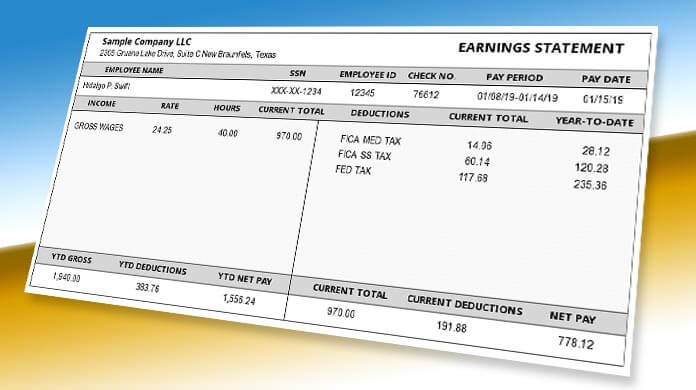

A pay stub, also known as a payslip, is a document that lists details about an employee’s pay. More specifically, it includes your gross wage, deductions, and your net pay.

Why is it important? It serves as proof of income. For example, you might need it if you’re trying to rent a new place or sign up for a bank loan. Put it simply, it lets the other party know that you’re bringing enough money in to cover your expenses.

Not only that, but it allows you to check for inaccuracies in your pay. After all, mistakes happen! For example, there might be incorrect deductions for insurance.

Last but not least, it can come in handy when you’re preparing your taxes. That is, you can use the pay stubs to keep track of what’s being taken out during each pay period.

3 Things to Include In a Pay Stub

Like we said earlier, there are three things that you want to include in a paystub. Let’s take a closer look at each of them below.

#1: Gross Wages

Gross wages are the total amount paid by an employer prior to taxes and other deductions. As such, it will be higher than your net pay. To calculate it, divide your annual pay by the number of times that you’re paid.

#2: Deductions

Deductions are amounts that are taken away from your gross pay. Common deductions include federal, state, and local taxes. Not only that, but you may have to contribute to insurance premiums.

#3: Net Pay

The net pay is your take-home amount (i.e. the amount that you’ll get after the deductions). Generally speaking, both the current new pay and the year-to-date net pay will be listed on the pay stub.

Creating Your Own Pay Stubs

There’s more than one way to generate pay stubs. For instance, you can use a spreadsheet program such as Microsoft Excel. In addition to that, there are automatic pay stub generators that you can use. Basically, all you have to do is fill in the information and it’ll generate the slip for you!

Understanding Pay Stubs

Hopefully, that answers the question, “what is a pay stub.” As you can see, it has several uses.

For more articles like this, check out the rest of our site!