Cash flow statement is undoubtedly a crucial tool for understanding a company’s financial health. In this article, we will be taking a closer look at what this tool is, and how important it is for every business.

We will keep things simple and straightforward, breaking down the concept into bite-sized, easy-to-understand pieces. To bring the discussion to life, we will examine a real-life example from the statement of cash flows for Sioux, a limited company.

If you have been struggling to understand the concept of cash flow statement, we believe this piece would help. So just keep reading!

What is Cash Flow Statement?

Let’s get started by first identifying what a cash flow statement is. A cash flow statement is like a financial diary for a company. It tells us how cash enters and exits the business over a period of time.

Think of it as tracking your own spending and earnings, but for a whole company. This statement shows three main activities: cash from operating (daily business), investing (buying or selling assets), and financing (dealing with loans or shareholders).

With a cash flow statement, you are not going to see just how much money a company makes, but also how it manages its cash. That way, such a company will be able to ensure it keeps running smoothly and meets its financial obligations.

How Is It Used?

The cash flow statement is used by investors, managers, and analysts to gauge a company’s financial strength. It’s like a health check-up, showing if the company has enough cash to pay its bills, invest in new projects, and grow.

Investors look at it to decide if they should buy or sell the company’s stock. Managers also use it to make smart decisions about day-to-day operations and long-term planning.

What Are the Main Components of Cash Flow Statement?

The cash flow statement has three main components that paint a complete picture of a company’s cash activity:

#1. Operating Activities

This section shows the cash generated or used in the core business operations. It tells us if the company is making enough money from its products or services to cover its costs and generate profit.

#2. Investing Activities

Here, we see cash involved in buying or selling long-term assets like property, equipment, or investments. This part helps us understand how the company is investing in its future growth or getting cash from selling off its assets.

#3. Financing Activities

This last section reveals how the company raises cash from debt or equity and how it pays these back. It includes loans, repayments, and dividends to shareholders, showing how the company manages its financing and shareholder relationships.

How Is Cash Flow Calculated?

Calculating cash flow in a statement involves tracking all the cash that comes in and goes out of the company in the three areas we have mentioned above.

Don’t worry; we will still explain this better with an example, statement of cash flows for Sioux, a limited company. But before then, here is an overview of the process.

1. Operating Activities

Here, you start with net income from the income statement, then adjust for non-cash items like depreciation and changes in working capital (like inventory and accounts receivable/payable).

These adjustments convert the net income from an accrual basis to a cash basis, showing the actual cash generated or used in operations.

2. Investing Activities

This section calculates the net cash used in or provided by investing activities. You add up all the cash spent on purchasing assets and subtract the cash received from selling assets. It shows the net cash flow related to the company’s investments in long-term assets.

3. Financing Activities

To calculate this, you sum up all cash inflows from issuing debt or equity and subtract cash outflows like dividends paid and repayment of debt. This provides the net cash flow from activities related to financing the company’s operations.

By summing up the net cash flows from these three activities, you get the total net increase or decrease in cash for the period. This total is then adjusted with the opening cash balance to arrive at the closing cash balance, reflecting the company’s cash position at the end of the period.

Statement of Cash Flows for Sioux a Limited Company

Now, let’s take a real-life plunge into all these by seeing the statement of cash flows for Sioux, a limited company. We will use it to explain all that we have been saying so far about calculating cash flow statements.

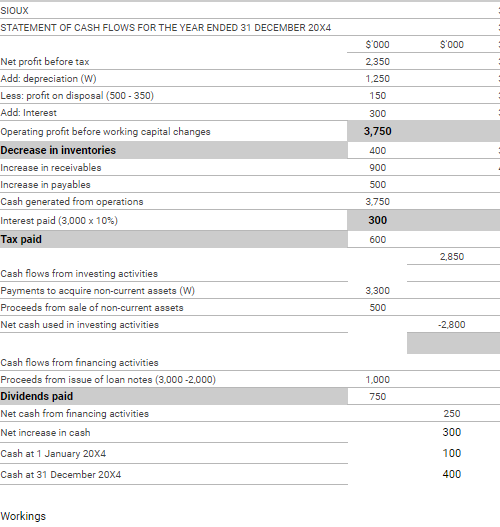

Let’s use the above picture to walk you through the calculations and explain what they tell us about the company’s cash flow for the year ended 31 December 2024.

Operating Activities:

- The company starts with a net profit before tax of $2,500.

- It then adds back non-cash charges such as depreciation ($1,250) and any losses from the sale of assets ($350) because these do not involve the actual movement of cash.

- It also adds back interest ($300), which is a financing cost but is included here to show the cash operations before financing expenses.

- Changes in working capital include a decrease in inventories ($400), which is added back because it represents cash not spent on restocking, and an increase in receivables ($900) and payables ($500), which are adjusted to reflect how cash is tied up in receivables or released from payables.

- After all adjustments, the cash generated from operations is $5,300.

- Interest paid ($600) and taxes paid ($2,600) are cash outflows and are subtracted, leading to a net cash flow from operating activities of $2,850.

Investing Activities:

- The company spent $3,300 on purchasing non-current assets. This is cash going out of the business and is subtracted.

- Cash proceeds from the sale of non-current assets amount to $500. This is an inflow and is added.

- Net cash used in investing activities is therefore $2,800 (outflow).

Financing Activities:

- Sioux issued loan notes and raised $1,000 in new financing.

- Dividends paid to shareholders amounted to $750, which is a cash outflow.

- Net cash from financing activities is the difference between these figures, which is $250 (inflow).

Net Increase in Cash:

- To find the net increase in cash during the year, you sum the net cash flows from each of the three activities: $2,850 (operating) + (-$2,800) (investing) + $250 (financing) = $300.

- The opening cash balance at 1 January 2024 was $100.

- Adding the net increase in cash ($300) to the opening balance ($100) gives us the closing cash balance at 31 December 2024, which is $400.

This statement shows that Sioux a Limited Company has a positive cash flow from its operating activities, indicating that its core business operations are generating more cash than they use.

However, the company has also spent a significant amount on investments, which could be a sign of investing in future growth. After accounting for financing activities, the company’s cash position has increased by $300 over the year.

Is Cash Flow Statement the Same as Income Statement?

It is not uncommon to see many people confuse these two statements. But the truth is, cash flow statement is not the same as the income statement.

While both are key financial documents, they serve different purposes and provide different insights into a company’s financial status.

The income statement shows a company’s profitability over a certain period. It records revenues, expenses, gains, and losses to calculate net income.

The income statement uses the accrual basis of accounting, where transactions are recorded when revenues are earned or expenses are incurred, regardless of when the cash is actually received or paid.

On the other hand, the cash flow statement focuses exclusively on the cash transactions. It shows how changes in the balance sheet accounts and income affect cash and cash equivalents.

It tells us how the company generates and uses cash, giving us a clear view of the company’s liquidity and solvency.

Cash Flow Statement vs. Balance Sheet

The balance sheet provides a snapshot of a company’s financial position at a specific point in time. It lists the company’s assets, liabilities, and shareholders’ equity.

Assets are what the company owns, liabilities are what it owes, and shareholders’ equity represents the net value of the company, which is the residual interest in assets after deducting liabilities.

While the balance sheet can tell you what the company owns and owes at a given time, the cash flow statement tells you where the company’s money came from and where it went during a certain period.

The balance sheet might show a company with lots of assets and equity, but the cash flow statement could reveal that the company is struggling with cash on hand.

Conversely, a company might have a strong cash position but be heavily leveraged with debt, as shown on the balance sheet.

Final Note

If you have read to this point, then you already have a complete idea of what a cash flow statement is. A cash flow statement is a crucial tool that every business should know how to use to evaluate its present financial stability.

We have also shown you a real-life example using a statement of cash flows for Sioux, a limited company to help you better understand. If you still have some more questions or concerns about the subject, just let us know in the comment section below. We will be happy to help!