Are you trying to find a way to do your business payroll without hiring a payroll service? Well, luckily for you there’s a way to do it. When your company is just getting started, it’s usually more cost-efficient to do your own wage paperwork, but keep in mind that it’s also complex.

There are certain steps that you need to take to ensure that it’s done properly. With that said, if you want to learn how to do payroll yourself, check out the instructions below:

Have Every Worker Fill Out a W-4

Workers need to fill out the W-4 form to register their filing status and keep a record of individual allowances in order to get a paycheck. The more employers with allowances or dependent family members, the fewer federal taxes are taken from their salaries for each pay cycle. You must issue a new recruiting report for every new worker you hire.

Get Employer Identification Numbers

Be sure to have your Employer Identity Number (EIN) prepared before you start your own payroll. For businesses, an EIN is like an SSN that is utilized by the IRS to describe a company agency that pays workers. You will need to get a state EIN number as well. To do so, search the workplace services of your state for more information.

Create a Payroll Schedule

Get insured and showcase office posters after you file with your business identity numbers. You will need to assign three major dates to the calendar. Those dates include salary dates for workers, due dates for payroll refunds, and deadlines for tax filings.

Calculate Income Taxes

You can determine the federal and state taxes to deduct from the salaries of your workers by using the IRS Withholding Calculator. You’ll also need an accurate salary calculator to figure out the services of your state.

Furthermore, it’s a must that you keep records of taxes on your workers and your company.

File Taxes and W-2’s

Lastly, make sure to submit annual tax returns and any state or local returns. Remember to prepare the yearly filings and W-2s at the end of the year. Not only that, but you need to send your federal, state, and local tax reserves when the time comes to pay taxes.

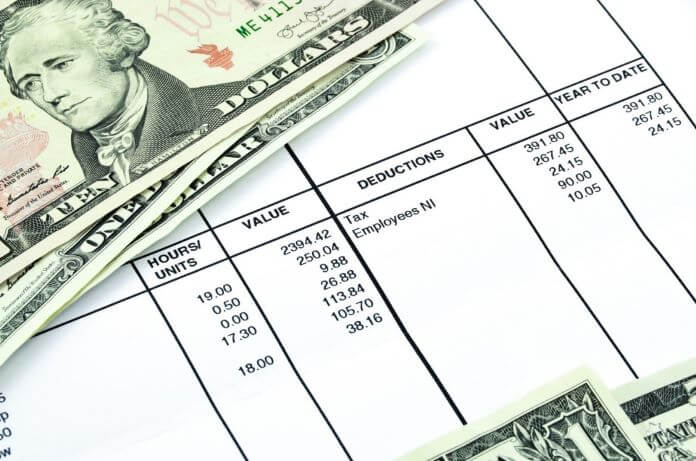

In addition to the steps listed above, if you decide to do your own payroll, you’ll need a stub creator to help you design the layout for your employee check stubs.

How to Do Payroll Yourself

Doing your own payroll is possible, and it doesn’t require too much work if you have a small number of employees. However, it is challenging at times, and of course, the workload increases as your company grows. Thankfully, there are plenty of tools out there —like stub creators—to assist you with the process.

If this article helped you understand how to do payroll yourself, feel free to browse more of our website. We publish topics about money, education, and starting a business. Read on to learn more.