Halo Financial is a UK-based foreign exchange provider that was founded in 2005. Many new tech-driven competitors have entered the space since Halo Financial entered the scene but the company has managed to remain relevant by excelling at its commitment to provide superior service with the help of its currency exchange specialists.

According to the Halo Financial Review by MoneyTransferComparison, the company boasts one of the top editorial ratings with a satisfaction level of 94% based on more than 90 aggregated reviews.

Who Is Halo Financial?

Halo Financial was born in the early 2000s as an alternative to automated and impersonal money transfer rivals. By contrast, a Halo international money transfer transaction is meant to be personal, friendly, efficient, and when required, offer a human solution to complicated problems.

The company is one of many in the very crowded space where there is little differentiation among rivals. All money transfer companies perform the same basic task of accepting one currency and exchanging it for another.

The major currency exchange providers are all able to offer a roughly similar exchange rate and complete a transaction in roughly the same amount of time. All of the providers typically display identical licenses and certifications under the Financial Conduct Authority and other entities.

So companies like Halo Financial have to find out how to stand out in different ways.

Prior to each Halo International money transfer, clients have access to personalized currency quotes and the option to interact with a specialist. Even if transactions are ever so slightly higher in cost compared to rivals, it includes the peace of mind required for large transfers.

What Services Halo Financial Offers

Halo Financial money transfer options are available for individuals or those people transacting from a business account.

Both individuals and businesses can transfer money at current exchange rates for immediate transactions if they need to pay a bill or send money to friends or family. Halo Financial specialists can also monitor the fast-changing forex market and notify a client when an exchange rate is in their favor.

The target demographic group Halo Financial’s team of currency exchange experts address are those looking to oversee larger-size transactions that may involve a major life change. Most notably, Halo Financial specializes in exchanging currency as part of the moving process to another country.

Life savings that need to cross borders can be expensive at a traditional bank and at a much higher cost.

Halo Financial notes on its website that it provides a dedicated currency conversion consultant to discuss each individual client’s wants and needs when it comes to moving their money to a foreign country. Sitting on the sidelines and not taking action in moving money across borders can notably impact the final amount of money received.

Other major transactions Halo Financial specializes in include overseas property buying. Sure, consumers can use one of many rivals but a Halo Financial money transfer for real estate includes the help of a currency broker with particular knowledge of these transactions.

In fact, the company notes more than 25% of transactions on its platform are individuals buying foreign property and need to exchange money for a down payment or full payment.

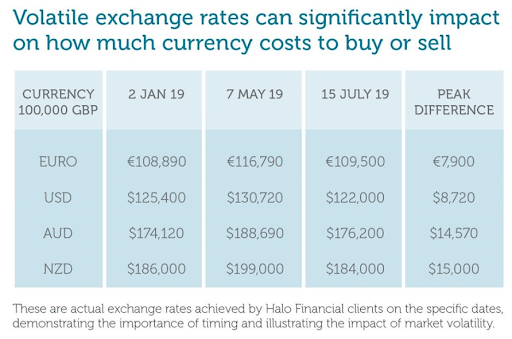

Regardless of the purpose of a money transfer, consumers have the option to enter a forward trade that consists of an agreement to buy and sell a currency pair in the future at a pre-agreed rate. As an example, if an individual agreed to buy a house in Paris for €800,000 it would cost around 687,000 pounds at current exchange rates. If the value of the pound falls 5% over the time period it takes to close the real estate transaction, the price of the same €800,000 house will now cost 721,000 pounds.

A forward contract at Halo Financial would eliminate volatility and risk as it guarantees a fixed exchange rate in the future. Business users can also take advantage of forward contracts if they know in advance that a large foreign currency transaction will be required in the future and they want to lock in an exchange rate today.

What Made Halo Financial So Popular During COVID

Compared to new tech-driven money exchange specialists like Transferwise, Halo Financial seems a relic of the past. There is some truth to this as Transferwise makes no secret it uses artificial intelligence technology to speed up transactions and drive costs as low as possible.

This might be an ideal proposition for younger individuals that only want to associate with tech disruptors. This certainly doesn’t appeal to the older generation transferring six-, seven-, or even eight-digit transactions to buy a second home.

Important to note, the older generation is typically less tech-savvy and might find a platform like Transferwise to be confusing. This isn’t to say that Transferwise isn’t an appropriate platform for older people. It is to say that Halo Financial’s focus on the human touch for all transactions is a superior alternative, especially during the COVID era when banks were shut down and consumers had no choice but to find suitable alternative options online.

Conclusion: Halo Financial Is Loved For A Reason

The MoneyTransferComparison emphasizes Halo Financial’s status as a services-oriented company — and for good reason. Help is a phone call away and the review notes the professionalism and knowledge of its staff.

It is evident that Halo Financial invests heavily in its staff to ensure its clients walk away happy after every transaction. Halo Financial money transfer options might be slightly more expensive than its peers, but few people would say it isn’t worth it.